As an agency that specializes in commercial and construction-related insurance risks, one of the most common statements we hear clients make is that they don’t need workers’ compensation and they don’t have payroll because they don’t have any employees, they only use ‘subcontractors’. They assume that by paying individuals on a 1099-basis that they are being smart and hiring ‘independent contractors’; thereby avoiding employer responsibilities and many entanglements that may arise from hiring someone as a W-2 employee.

As an employer, your misinterpretation of a worker's true employment status can cost you dearly.

To get right to the point, this is a big misconception, WRONG and very dangerous for your business. Why? Keep reading...

As a business owner you probably hire people on a regular basis either per-project, part-time or as-needed, and like many business owners, you want to avoid paying payroll taxes, you don’t want the ‘responsibility’ of an ‘employee’ and you choose to pay on a 1099-basis and then call these workers ‘subcontractors’ – but are they really - or do you simply assume they are ‘subcontractors’ because you don’t pay their taxes? What’s the real difference between a W-2-employee and someone paid on a 1099-basis? What happens is this ‘subcontractor’ becomes ill or gets injured related to their work? Can he or she sue you for wrongful termination or discrimination? Do you need workers' compensation? Are they entitled to any benefits you offer and can they come back against you for not providing them as you do for your W-2 staff?

To put a common myth to rest at the start, you need to understand that paying someone on a 1099-basis and making them responsible for their own employment taxes each year is DOES NOT automatically make them a subcontractor or independent contractor. The ‘1099’ versus W-2 is only a concern for the IRS in regards to which party is responsible for paying employment taxes. That’s it. Either they pay their own payroll taxes or you do. In the event of an injury, illness or issues regarding wages, it’s the Department of Labor that determines employment status based on some established criteria listed lat the end of this article.

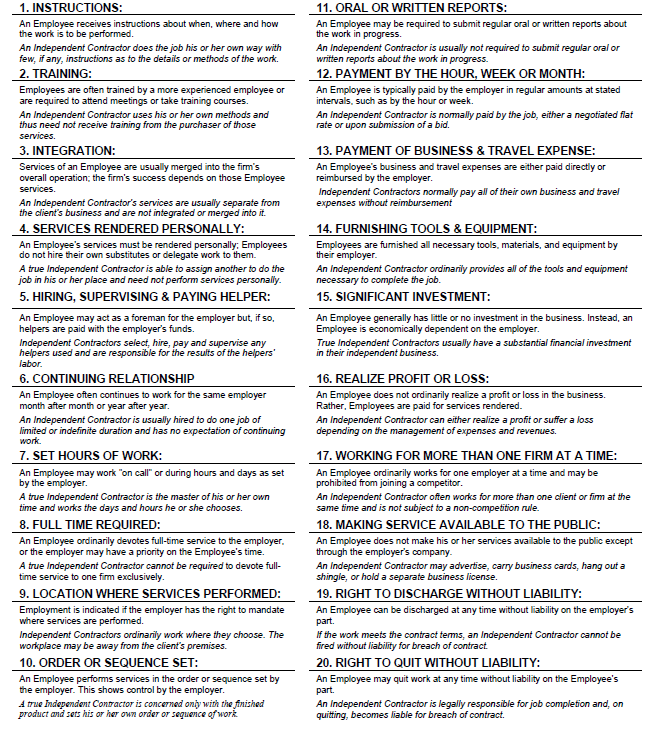

The IRS itself uses three characteristics to determine the relationship between businesses and workers:

- Behavioral Control covers facts that show whether the business has a right to direct or control how the work is done through instructions, training or other means.

- Financial Control covers facts that show whether the business has a right to direct or control the financial and business aspects of the worker's job.

- Type of Relationship factor relates to how the workers and the business owner perceive their relationship.

If you have the right to control or direct not only what is to be done, but also how it is to be done, then your workers are most likely employees.

If you can direct or control only the result of the work done -- and not the means and methods of accomplishing the result -- then your workers are probably independent contractors.

Employers who mis-classify workers as independent contractors can end up with substantial tax bills as well as responsibility for injuries and work-related issues. Additionally, they can face penalties for failing to pay employment taxes and for failing to file required tax forms.

Under the common law test, a worker is an employee if the purchaser of that worker's service has the right to direct or control the worker, both as to the final results and as to the details of when, where, and how the work is done. Control need not actually be exercised; rather, if the service recipient has the right to control, employment may be shown. Depending on the type of business and services performed, not all twenty of the common law factors may apply, In addition, the weight assigned to a specific factor may vary depending on the facts of the case. IF AN EMPLOYMENT RELATIONSHIP EXISTS, it doesn't matter that the employee is called something different, such as subcontractor, contract labor, independent contractor or agent.

Open the Employment Status PDF

Have questions or need a quote for workers' compensation, general liability or have any another insurance needs? Call us at (512) 759-8959 today or email us at service@hhisinc.com